Recurring billing via ACH (Automated Clearing House) is one of the most cost-efficient ways for businesses to collect regular payments (subscriptions, memberships, service fees). But “cost-efficient” does not mean “cost-free.” There are many nuances around ACH processing fees, chargebacks, return fees, timing, and how to negotiate or structure your setup...

The Difference Between Encryption and Tokenization in Payments

In the domain of payment processing and financial data security, the terms encryption and tokenization are often used—and sometimes misused—as if they are interchangeable. Yet, while both encryption and tokenization aim to protect sensitive data, they operate in fundamentally different ways, and each has unique strengths, trade-offs, and applications. Understanding...

How Tokenization Protects Customer Payment Data

In today’s digital economy, protecting customer payment data is no longer optional — it’s essential. Every time a consumer enters their credit card number, expiration date, or CVV into an e-commerce site, mobile app, or point-of-sale device, sensitive data is transferred through multiple systems. Cybercriminals continuously evolve methods to intercept...

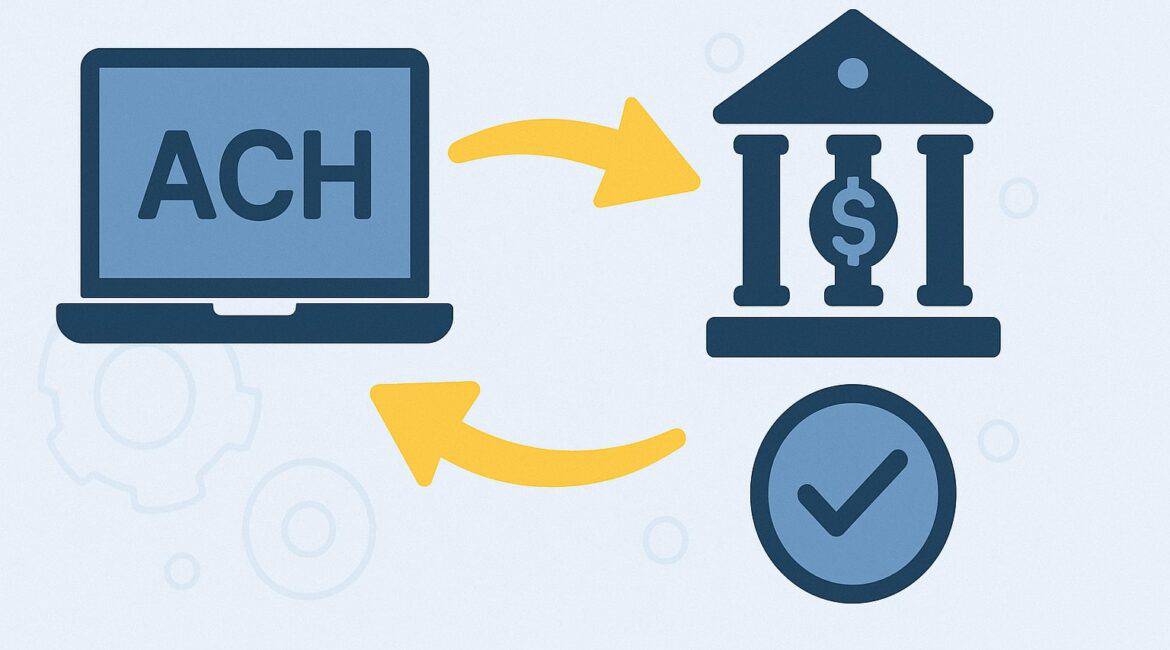

Guide to Accepting ACH Payments for Your Business

Harnessing efficient payment methods is crucial for modern businesses. Accepting Automated Clearing House (ACH) payments can open the door to new customers and streamline cash flow. ACH payments allow secure bank-to-bank transfers that bypass paper checks and high credit-card fees, making them a cost-effective alternative for businesses. In fact, NACHA...

What Is an ACH Transfer and How It Works

An ACH transfer (Automated Clearing House transfer) is an electronic movement of money between bank accounts in the United States. It’s the foundation of many routine payments – for example, payroll direct deposits, monthly bill payments, tax refunds, and consumer-to-business transfers – and is governed by rules set by the...

How to Reduce POS System Costs: Smart Strategies for Small Businesses

Reducing POS system costs is essential for small business owners, retailers, and restaurants seeking to maximize profitability. Modern point-of-sale (POS) systems can carry significant upfront and ongoing expenses – from hardware (like cash drawers, card readers, and touchscreen terminals) to software subscriptions and payment processing fees. However, there are many...

Mobile POS Solutions: How to Take Payments Anywhere

Mobile point-of-sale (POS) solutions transform smartphones and tablets into portable cash registers, enabling businesses to take payments anywhere with ease. These systems pair a mobile app with a compact card reader or smart terminal, allowing vendors – from small retail shops and event stallholders to freelancers – to process credit...

Guide to Accepting International Credit Card Payments

Accepting international credit card payments allows U.S. businesses to tap into the vast global market. Cross-border e-commerce is booming – global online retail sales are projected to total around $4.8 trillion by 2025 (about $6 trillion in 2024). By enabling payments from abroad, small businesses, e-commerce platforms, and freelancers can reach millions...

How Membership Payment Programs Help Eliminate Hidden Fees

In recent years the membership economy has surged, reflecting a shift toward subscription and flat‑rate pricing models. Forbes projects that the global subscription market will reach $1.5 trillion by 2025, as businesses and consumers alike gravitate toward predictable pricing. At the same time, there is growing consumer backlash against “hidden...

How to Choose the Best Payment Processor for Your Business

Choosing the best payment processor for your business is a critical decision. Modern businesses – whether e-commerce stores, brick-and-mortar shops, SaaS platforms or freelancers – must accept payments online and in person quickly, securely and cost-effectively. The right payment processor can streamline customer checkout, handle multiple payment methods (credit/debit cards,...