By Annabelle King September 18, 2025

Mobile point-of-sale (POS) solutions transform smartphones and tablets into portable cash registers, enabling businesses to take payments anywhere with ease. These systems pair a mobile app with a compact card reader or smart terminal, allowing vendors – from small retail shops and event stallholders to freelancers – to process credit and debit card transactions on the go.

In the United States, mobile POS solutions have surged in popularity, driven by advances in mobile payment technology (like chip cards, NFC contactless, and digital wallets) and by the needs of businesses to sell outside fixed stores.

According to recent industry data, over two-thirds of small businesses worldwide now use mPOS systems, and North America accounts for the largest regional share of the mPOS market (over 35%).

This article explores how mobile POS solutions work, their benefits for SMBs, key features, security and regulatory considerations, and how leading providers (Square, Shopify POS, SumUp, PayPal Zettle, Clover, etc.) compare.

Mobile POS systems essentially run a payment app on a smartphone or tablet paired with a card reader. This setup typically accepts payments via magnetic swipe, EMV chip, or NFC contactless methods (including Apple Pay/Google Pay) by tapping a customer’s card or device on the reader.

The mobile device’s internet connection (Wi-Fi or cellular) communicates with payment networks to authorize transactions. In practice, this means a food truck, market stall, home service provider or even a sidewalk coffee cart can accept credit cards just like a physical store.

Notably, Apple’s Tap to Pay on iPhone feature (introduced in 2022) and Visa/Mastercard “tap to phone” programs allow some smartphones themselves to act as NFC card readers without extra hardware, further easing on-the-go payments.

How Mobile POS Systems Work

A mobile POS system typically includes three components:

- A smart mobile device (smartphone or tablet) running POS software/app,

- A card reader or terminal (e.g. magstripe reader, chip/contactless reader, or smart terminal) that connects via Bluetooth or headphone jack, and

- An internet connection to the payment processor.

When a customer pays, the merchant enters or scans the sale amount on the app, then the customer swipes, dips, or taps their card or smartphone on the reader. The transaction is then routed to a payment processor or bank for authorization.

Many modern mPOS solutions support multiple tender types (credit/debit cards, chip EMV, NFC/contactless payments, mobile wallets) and even QR code or PayPal/Venmo payments, all processed through one account. The app records the sale, often printing or emailing a receipt from the phone. In essence, the phone/tablet becomes a fully functioning register.

Unlike traditional bulky cash registers, mPOS systems are portable and lightweight. They often come as small card-reading devices, sometimes no bigger than a credit card (e.g. Square’s magstripe reader).

For example, Square’s portable reader is “pocket-sized” yet handles magstripe, chip, and contactless transactions. Clover’s Go reader similarly connects via Bluetooth to any iOS/Android device, and it supports Tap-to-Pay on iPhone as well as chip and contactless payments.

The apps for these systems are downloadable to iOS or Android phones/tablets, so a business can literally carry its POS with them wherever sales occur.

Because the hardware is minimal (a phone plus reader), setup and costs are lower for mobile POS. Most providers charge no monthly fee for basic software (especially Square, PayPal, SumUp) and only require transaction fees on each sale.

In many cases, the card reader itself can be free or under $50, making it accessible for small startups. Mobile POS solutions often include additional point-of-sale features in their apps: inventory tracking, sales reporting, customer data, tipping prompts, and more.

This makes them appealing for modern small businesses that want flexible selling without the overhead of a full on-premise system.

Key Features and Benefits

Sell Anytime, Anywhere

The core benefit of mobile POS solutions is mobility. A plumber, florist, food truck, or craft vendor can accept credit cards at the customer’s location, at events, or in a waiting area – from virtually any location.

For instance, a food truck vendor can take orders and payments directly at the window; a wedding photographer can charge clients on site; an art fair seller can process cards without a fixed booth.

By contrast, traditional POS terminals are fixed to a countertop. Mobile POS “lets you take payments on the move — whether you’re working at a market stall, on-site with a customer, or at a pop-up event”.

Lower Costs and Ease of Setup

Mobile POS software is generally free to download (no license fee) and links to a merchant payment account. There are usually no long-term contracts or installation fees, which reduces startup cost.

For example, Square offers a “forever-free” POS app plan for retail and service businesses, with a free magstripe card reader included. You can be “selling and accepting payments in a matter of hours” with such systems.

By contrast, legacy POS often involved expensive terminal leases and set-up fees. The low barrier to entry is why many small businesses, freelancers, and seasonal vendors opt for mobile POS.

Modern Payment Technology

Mobile POS readers accept chip (EMV) cards and contactless/NFC payments, which is important for current payment standards. In the US, EMV chip cards became ubiquitous after liability shifts, and mobile POS systems like Square provide chip and tap readers as standard.

They also support Apple Pay, Google Pay and other digital wallets via NFC. Notably, Apple’s Tap to Pay feature (launched 2022) enables an iPhone to accept contactless payments directly through a POS app, so merchants may not even need a separate reader.

Similarly, Visa’s “Tap to Phone” lets merchants accept NFC payments on their own smartphones through a secure app. These advances mean customers can use the latest convenient payment methods anywhere a mobile POS is used.

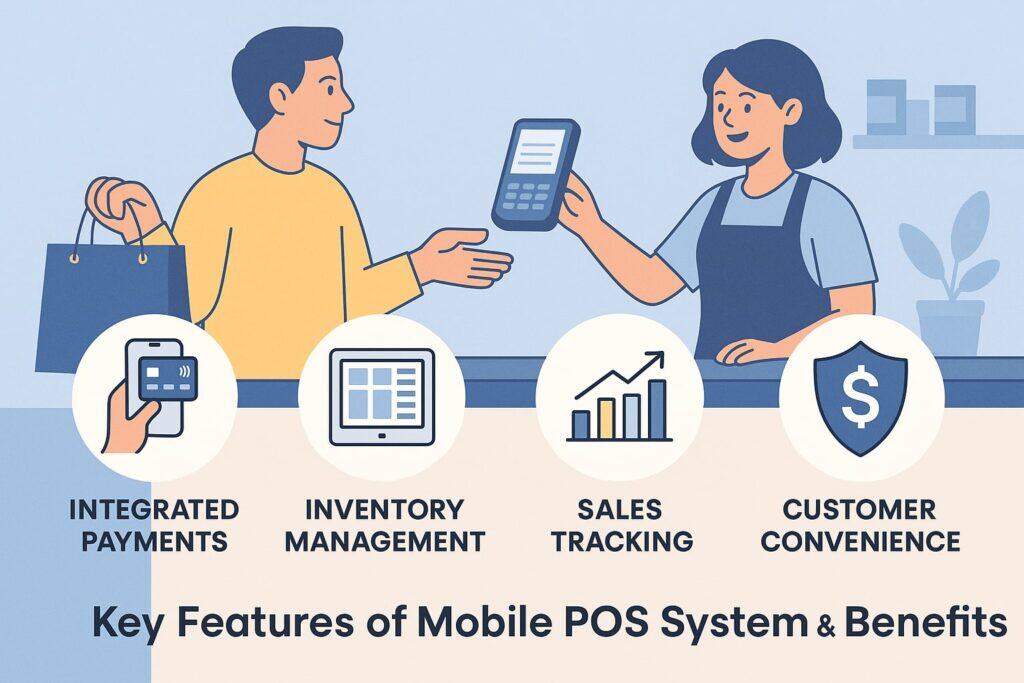

Integrated Business Tools

Modern mobile POS apps do much more than swipe credit cards. They often include features like inventory management, CRM (customer data), invoicing, discounts and promotions, digital receipts, and reporting dashboards.

For example, Square’s app can track stock levels and notify you of low inventory, manage multiple items and variants, and build customer profiles.

Shopify POS, aimed at omnichannel sellers, provides unified inventory across online and in-person sales, and robust sales reporting. These integrated tools help small businesses manage sales and customers holistically, even with a lean setup.

Improved Checkout Experience

With mobile POS, checkouts can be faster and more professional. Cashiers using tablets or smartphones can walk to the customer with the reader (improving service at table or line), or allow self-checkout by QR code.

Digital receipts and email invoicing reduce paper and manual bookkeeping. Also, because mobile devices are user-friendly, staff training is usually faster. As one Square reviewer notes, “Sign-up to take a payment in under 15 minutes”. These efficiencies mean happier customers and less friction in payment flow.

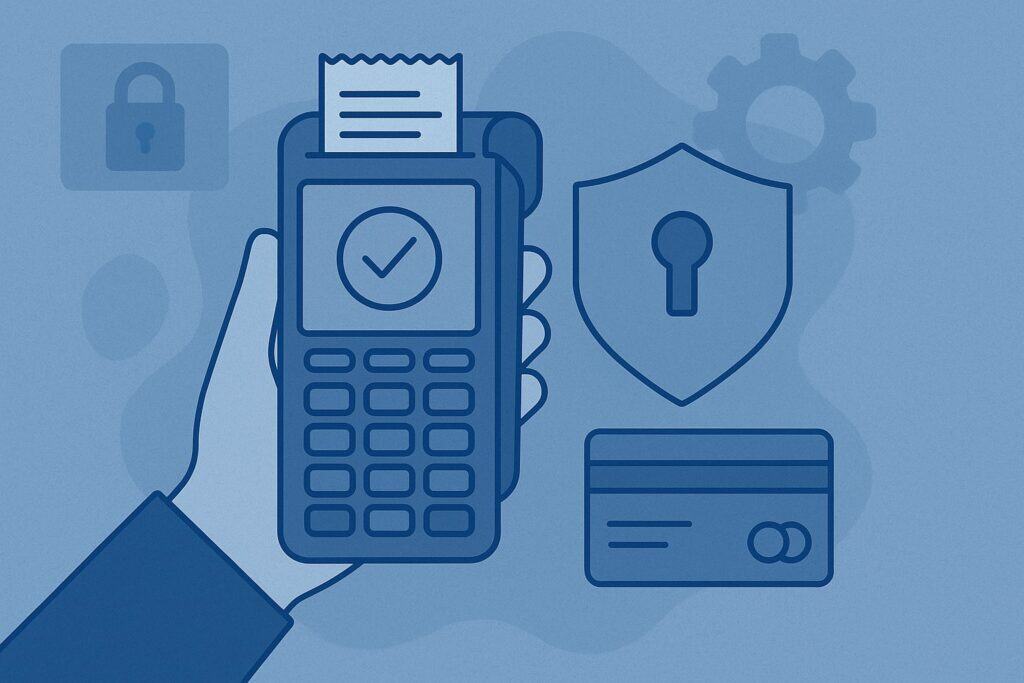

Security and Compliance

Even though mobile POS uses personal devices, security standards are as strict as for traditional POS. All mobile POS solutions must be PCI-compliant, encrypt payment data, and often include fraud protection features.

Merchants should ensure their chosen app encrypts card data end-to-end (often via tokenization) and that the provider is Level 1 PCI certified. Square, for example, emphasizes that “security is a must for mobile POS payments” and that their service includes PCI compliance and encryption for every payment.

Mobile POS can actually improve security in some ways: contactless (NFC) transactions are more secure than magnetic stripe swipes because they use encrypted chip token data. Also, many apps automatically update to patch vulnerabilities.

However, business owners should still follow best practices: keep devices’ operating systems updated, use strong passwords, and never store card numbers locally. Some providers like Square and PayPal also offer optional security add-ons (e.g. end-to-end encryption devices or fraud monitoring) at no extra cost.

Accepting All Payment Types

One major advantage of mobile POS solutions is broad payment acceptance. Every modern system accepts magstripe and chip credit/debit cards, EMV smart cards, and contactless/NFC payments (Apple Pay, Google Pay, Samsung Pay, etc.).

For instance, Clover’s Go reader “accepts chip, dip, and contactless payments including Tap-to-Pay on iPhone, Apple Pay, Google Pay and Samsung Pay.” Square’s contactless/chip reader likewise handles all these formats.

Many also support remote payments: the software can send payment links or invoices for online or phone transactions, though often at a higher “card-not-present” fee.

Some mobile POS systems integrate with QR code payments: PayPal’s Zettle (PayPal Point of Sale) can generate a QR code for customers to scan and pay from their own wallets. This can be handy at outdoor markets or curbside pickup.

Others allow integration with digital wallets beyond Apple/Google – for example, Square can accept Venmo QR codes or even WIC/EBT transactions depending on the app. In short, a well-chosen mobile POS solution can handle the same payment methods as a full countertop terminal, keeping checkout options flexible.

Offline Mode and Connectivity

Mobile POS systems rely on an internet connection (cellular or Wi-Fi) to send transactions for authorization. Most popular solutions do offer offline mode features, which can be critical at events or remote locations with spotty connectivity.

For example, Square and Clover allow taking payments in offline mode (storing encrypted transactions on the device until an internet connection is re-established). PayPal Zettle also notes an upcoming offline mode to handle connectivity outages.

However, offline functionality varies: usually only transactions above a certain risk level or amount are blocked offline, and you cannot do things like refunds or updates until online. It’s wise to confirm offline capabilities when selecting a system, especially for outdoor or traveling businesses.

Overall, though, the ubiquity of cellular data today means most mobile POS users stay connected. Modern card readers use Bluetooth Low Energy to pair with the phone, so as long as the phone has data, payments flow through the cloud seamlessly.

Compliance and Regulations in the US

For businesses in the United States, mobile POS solutions must abide by the same regulations as any payment system. The biggest area is PCI DSS (Payment Card Industry Data Security Standard) compliance.

Luckily, most mobile POS providers take on PCI compliance as part of their service, so the merchant’s scope is limited. The key is to use a certified solution and not manually record or store unencrypted card data.

EMV (chip card) compliance is already universal in the U.S., so any mobile POS must support EMV or risk liability. Contactless (NFC) acceptance is encouraged and generally fee-free.

Another consideration is state tax and reporting: a POS system can help calculate sales tax by location (and many mobile POS providers automatically calculate or file sales tax for you). One should ensure the mobile POS app is configured for correct tax rates (especially if selling in multiple states or online).

Apple’s privacy rules (for iPhone apps) and Google’s Android requirements also apply to mobile POS apps, but reputable providers handle these. There are no special banking regulations unique to mPOS beyond standard money transmission and merchant account rules. Overall, mobile POS is fully compliant when best practices are followed.

Choosing the Best Mobile POS System

Not all mobile POS solutions are identical. Key factors for small businesses include pricing, hardware costs, supported devices, and feature set. Here are some considerations:

- Fees and Pricing Model: Most mobile POS providers charge a per-transaction fee (e.g. 2.6% + 10¢) and no monthly software fee for basic use. However, fees can vary. For example, Square charges 2.6% + 10¢ per in-person swipe/dip/tap.

SumUp also charges 2.6% + 10¢ for in-person transactions. PayPal Zettle charges 2.29% + 9¢ for card-present swipes, and 3.49%+49¢ for invoice payments. Shopify POS, on the other hand, ties to a subscription: the basic Shopify e-commerce plan ($29+) includes POS Lite, but unlocking full POS Pro costs ~$89/mo per location.

Its in-person rate is 2.4% on certain plans. Very low volume sellers should look for $0 monthly options (Square, PayPal, SumUp, Clover Go). High volume stores might negotiate rates. - Hardware Costs and Device Compatibility: All systems support iOS and Android phones/tablets; some like Clover Go mention iOS ≥15 and Android ≥9 requirements.

Hardware cost varies: Square gives away a simple magstripe reader for free, sells a chip/contactless reader for $59. SumUp’s card readers range from $54–$169 depending on model. PayPal POS card readers start at $29 (plus optional dock).

Clover Go costs $119 (includes one-time fee, with optional monthly add-ons). Many providers offer a “free starter kit” with certain commitments. Businesses should check if their device (phone/tablet) is supported and what readers are needed for EMV/contactless. - Integration and Ecosystem: Consider whether the POS integrates with other tools. Square and Clover have app marketplaces. Shopify POS integrates deeply with Shopify’s online store.

PayPal POS integrates seamlessly with PayPal accounts and Venmo, which can help with PayPal-savvy customers. SumUp’s advanced plans include built-in marketing and loyalty tools. If accounting or e-commerce sync is important, choose accordingly. - Offline and Features: As noted, offline mode is available in Square and Clover; others may require connectivity. Inventory and customer management are included in most paid plans; check if advanced loyalty, gift cards, or employee management are supported if needed.

The user interface and support quality can also be factors – many providers advertise ease-of-use for beginners. - Payment Methods: If you need to accept not just cards but digital wallets or invoices, check that. For example, Shopify POS can accept tap-to-pay on compatible devices through the Stripe platform. PayPal POS naturally supports PayPal/Venmo QR codes.

Comparing Major Mobile POS Providers

Below is a summary comparison of popular mobile POS providers:

| Provider | Software Fees | In-Person Rate | Offline Mode | Devices (iOS/Android) |

|---|---|---|---|---|

| Square | $0–$89/mo | 2.6% + 10¢ per swipe/dip/tap | Yes (limited) | iOS, Android |

| Shopify POS | $29+ (POS Lite) / $89 (POS Pro) | ~2.4% (with Shopify Payments) | Limited (iOS only for Tap to Pay) | iOS, Android |

| SumUp | $0 (basic) / $99–289/mo (POS plans) | 2.6% + 10¢ in-person | No | iOS, Android |

| PayPal Zettle | $0 | 2.29% + 9¢ card-present | No | iOS, Android |

| Clover Go | $199 one-time (starter) | 2.6% + 10¢ (with starter plan) | Yes (via app) | iOS, Android |

This table highlights the entry points. For example, Square offers a free plan with a complimentary magstripe reader (great for cost-conscious startups). PayPal’s POS is also free with a low reader cost, appealing to occasional sellers.

Shopify requires at least a paid plan, but integrates well with online stores. SumUp has no monthly fee for simple card readers, but charges for full POS software plans. Clover Go has a one-time device fee.

All the above options accept major card brands and contactless payments. Notably, Square and Clover offer offline transaction caching, useful for pop-ups. Shopify (via Stripe) now supports Apple Tap to Pay on iPhone, so merchants can take contactless credit cards on the phone itself. PayPal Zettle currently lacks true offline mode, so it’s best where connectivity is reliable.

Ultimately, the “best” mobile POS depends on your needs. For most small businesses, Square is a top choice due to its free software, ease of use, and built-in analytics. A recent analysis notes Square’s “generous free plan” and ease of setup as key advantages. However, if you already have a Shopify online store, Shopify POS makes multichannel selling easy. If budget is a priority, SumUp and PayPal Zettle are attractive low-cost options with simple pricing. For merchants wanting custom payment processors, Clover Go allows choice of merchant account (though at some cost).

Setting Up and Using Mobile POS

Getting started with a mobile POS system is usually straightforward:

- Sign Up: Create an account with the provider and link your bank account (some systems allow instant setup with just an email and business info).

- Download the App: Install the POS app on your smartphone or tablet. Square, for instance, provides an app on Apple App Store and Google Play for free.

- Obtain a Card Reader: Either order the free or paid card reader from the provider (Square and PayPal send free magstripe readers on signup, SumUp and Clover sell theirs). Pair it with your device via Bluetooth or plug-in.

- Configure Settings: Set up your business details, tax rates, items/catalog, and tipping options in the app’s settings. Input your products if selling inventory, or be ready to enter custom amounts.

- Take Payments: To make a sale, open the app, enter the amount or select products, then swipe/dip/tap. If tapping a card or phone, just hold it near the reader. The app will authorize, record the sale, and optionally email a receipt to the customer.

- Review Sales: In the dashboard, you can view sales reports, refund transactions if needed, and manage customers.

Most mobile POS vendors provide tutorials or quick-start guides. For example, Square’s guide emphasizes plugging in the provided magstripe reader or pairing the chip/tap reader, then swiping or tapping to charge. After each sale, you or the customer can provide an email or phone for a receipt. Over time, the system saves a sales history and customer list.

Mobile Payment Trends and US Context

Mobile POS adoption continues rising rapidly. Recent industry reports note the global mPOS market reached nearly $50 billion in 2025, with 113 million mPOS devices in circulation. In the US specifically, mobile and contactless payments are mainstream.

Apple Pay alone is accepted by over 90% of US retailers, and now merchant apps can offer customers “tap to pay” directly. Among small businesses, surveys show many plan to invest in mobile POS solutions for flexibility; one study found about 33% of North American retailers are upgrading to mPOS for faster transactions on the sales floor.

Legislation and regulation in the US have generally encouraged mobile payments. For example, efforts to standardize digital wallets and EMV compliance (such as chip mandates) have been fully implemented, so modern mPOS systems are fully embraced.

COVID-19 and health concerns also boosted contactless acceptance, further underscoring mobile POS utility. In practice, using mobile POS in the US is legally the same as using any card terminal: make sure to charge the correct sales tax, report gross sales for tax purposes, and follow state business license requirements.

Overall, Mobile POS Solutions: How to Take Payments Anywhere is not just a slogan—it reflects the reality that even the smallest vendor can operate like a national retailer.

By leveraging smartphones or tablets, modern security, and robust software, businesses of all types can accept payments on the go, serve customers wherever they are, and manage sales efficiently.

Frequently Asked Questions

Q.1: What is a mobile POS system?

Answer: A mobile POS (mPOS) is a portable payment system that typically uses a smartphone or tablet paired with a card reader to process transactions. It turns your device into a cash register, letting you accept credit/debit cards, track sales, manage inventory and print or email receipts – all on the go.

Q.2: How do mobile POS solutions differ from traditional POS?

Answer: Unlike fixed POS registers at a checkout counter, mobile POS systems are mobile and lightweight. A traditional POS is fixed to one spot and often requires bulky hardware.

A mobile POS runs on a smartphone/tablet and can be used anywhere. This is ideal for businesses like food trucks, market stalls, or home-service providers that need flexibility.

Q.3: Are mobile POS payments secure?

Answer: Yes, when using reputable providers. Mobile POS systems use industry-standard encryption and are PCI-compliant. Data is encrypted end-to-end during transactions. Many apps have built-in fraud detection.

You should secure your own device (e.g. use a passcode) and keep the app updated. The convenience of mobile POS does not sacrifice security when set up correctly.

Q.4: What hardware do I need to accept payments anywhere?

Answer: At minimum, you need a compatible smartphone or tablet and a card reader. Providers often offer free or low-cost magstripe readers, and sold or free EMV/contactless readers. For example, Square provides a magstripe reader free at signup and a $59 chip/tap reader.

Some solutions (like Tap-to-Pay on iPhone) can even use the phone’s built-in NFC without extra hardware. Optionally, you might add a portable receipt printer or cash drawer if needed.

Q.5: Which payment methods can mobile POS accept?

Answer: A modern mPOS can accept all standard card payments: Visa, MasterCard, AMEX, Discover, etc., via magstripe, EMV chip, or contactless tap. They also support NFC wallets (Apple Pay, Google Pay).

Many apps let you send digital invoices or payment links for online payments (often at higher fees). PayPal-based POS can take PayPal/Venmo QR codes. Essentially, if it’s a common digital payment, an up-to-date mobile POS should handle it.

Q.6: Can I use a mobile POS offline?

Answer: Some can, to a limited extent. Providers like Square and Clover allow you to swipe/tap cards and record transactions when offline, then automatically process them when back online. Others, like PayPal Zettle, do not offer full offline mode yet.

Offline mode often has transaction size limits for security. If you plan to sell where the internet is unreliable (e.g. outdoor fairs), choose a system that explicitly supports offline transactions.

Q.7: How do mobile POS transaction fees compare?

Answer: Fees vary but are often competitive. Many mobile POS platforms use a flat-rate model. For example, Square charges 2.6% + 10¢ for in-person card transactions. SumUp also charges 2.6% + 10¢ in the U.S.

PayPal Zettle offers a slightly lower rate of 2.29% + 9¢ for card-swipes. These are comparable to or lower than traditional merchant services for low to medium volume. There are no monthly fees on the basic plans, which suits small sellers. Just be aware that keyed (card-not-present) or online transaction fees are typically higher (around 3–3.5%).

Q.8: Can I integrate mobile POS with my online store?

Answer: Yes. Some platforms shine here. Shopify POS naturally syncs with your Shopify online store inventory and sales. Square Online offers an e-commerce site that integrates with its mobile POS, though advanced features may need a paid plan.

Clover and PayPal POS also have e-commerce extensions. If you sell both online and in person, look for a system with omnichannel syncing. It keeps inventory accurate across channels and gives unified reporting.

Conclusion

Mobile POS solutions give small businesses the freedom to take payments anywhere with professional, reliable technology. Whether you’re a corner shop adding curbside pickup, a freelance vendor at festivals, or a startup delivering on-demand services, an mPOS system turns your existing smartphone into a powerful checkout device.

Today’s mobile POS solutions are rich in features – from inventory and customer management to omnichannel integrations – yet simple enough for a single person or a tiny team to use.

When choosing a mobile POS provider, consider factors like fees, hardware costs, offline capability, and compatibility with your devices and business tools.

Square, Shopify POS, SumUp, PayPal Zettle, Clover Go, and others each have strengths; compare their plans and pick one that matches your sales volume and workflow. Keep in mind the U.S. landscape: ensure PCI compliance (often handled by the provider), EMV and NFC support (now standard), and proper sales tax configuration.