By Annabelle King September 17, 2025

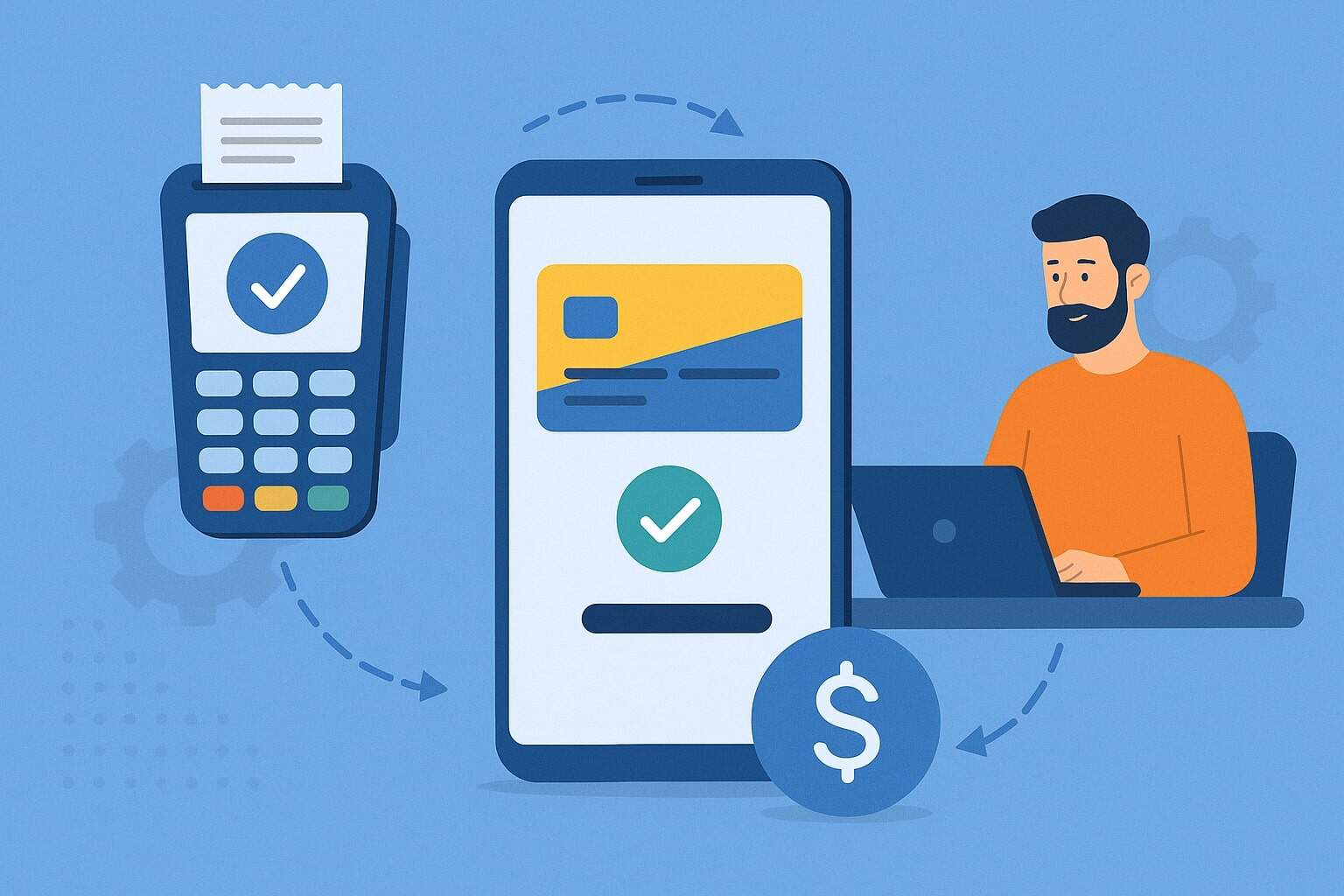

Payment processing is the behind-the-scenes system that lets businesses accept credit cards, debit cards, and other electronic payments online or in-store. When a customer pays—whether by tapping a card at checkout or clicking “Pay” on a website—secure payment data is routed through multiple intermediaries before funds arrive in the merchant’s account.

The diagram above illustrates this flow: customer payment details (from either a point-of-sale terminal or an online checkout) are sent through a payment gateway to the payment processor and banks for authorization, then finally settled and deposited into the merchant’s account. In short, a payment processing system ties together the customer, merchant, payment networks, and banks to complete the transaction.

Payment processing makes paying as simple as a tap or swipe for customers, hiding a complex sequence of steps in milliseconds. Yet these systems are vital: they speed transactions and secure data.

As one expert notes, “paying with a credit or debit card can be as simple as a tap and a ‘beep’ during checkout — or inputting their details online. But within that split second of making a payment, there are several underlying technical processes”.

Today’s businesses rely on electronic payments more than ever. In the US, digital payments have now surpassed traditional methods — nearly 90% of U.S. consumers made a digital payment in 2024 — so understanding how payment processing works is essential for any merchant.

Payment processing supports a wide range of transaction types: in-person retail sales (using card readers or POS terminals), online e-commerce checkouts, mobile wallet payments, bank transfers, and more.

Whether it’s a customer sliding a credit card at a store or entering card data on a website, the payment processing system will securely transmit, authorize, and settle the payment. In this guide, we’ll explain each component of that system and walk through the step-by-step journey of a payment from customer to merchant.

What Is Payment Processing?

Payment processing is the set of systems and steps that enable merchants to accept electronic payments. At its core, payment processing is “the system that allows businesses to accept electronic payments, including debit and credit card transactions”.

In other words, it’s the infrastructure that captures your customer’s payment data, transmits it securely, communicates with banks and card networks, and ultimately moves money from the customer’s bank account or card into the merchant’s bank account.

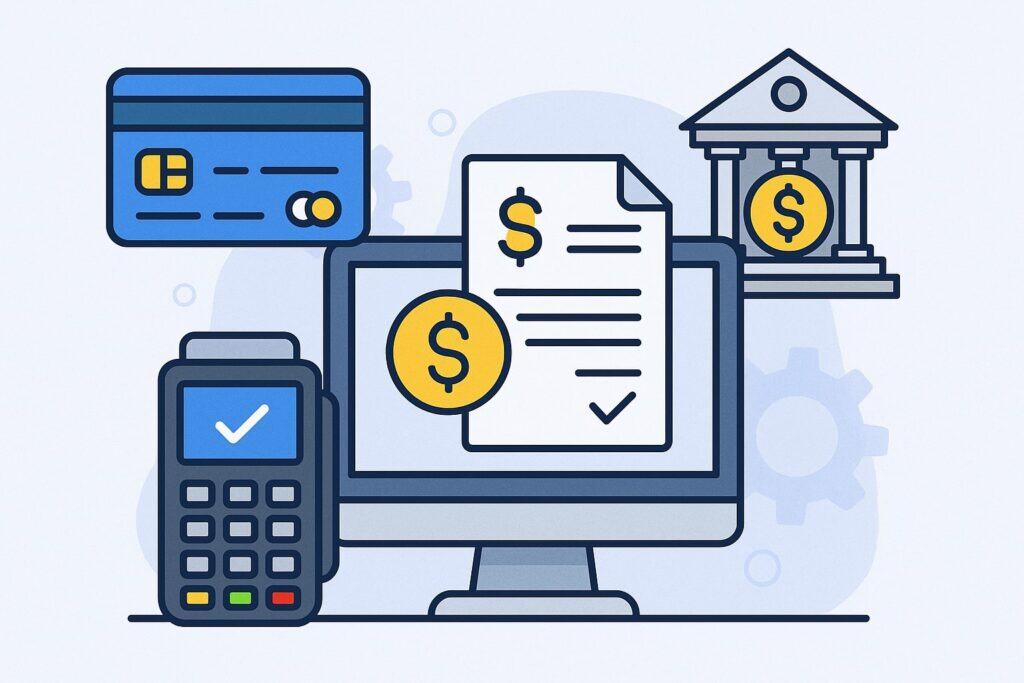

A complete payment processing system typically includes two main components: a payment gateway and a payment processor. The gateway securely captures and sends the payment data, while the processor handles the logistics of communicating with banks and completing the fund transfer.

Payment processing is essential because it makes the actual exchange of money fast, secure, and automated. When a customer pays by card, the system must quickly verify the card, check funds, and then record the sale, all within seconds.

According to industry sources, modern payment systems handle all communication between issuing banks (the customer’s bank), card networks (Visa, Mastercard, etc.), and the merchant’s bank — doing so almost instantly without any action needed by the cashier or shopper.

This speed and security are why digital and card-based transactions have largely overtaken cash and checks. Deloitte reports that check usage is declining to near extinction and electronic payments continue to grow in popularity.

With online commerce booming, a robust payment processing system is no longer optional but a necessity for businesses of all sizes.

Key Components of a Payment Processing System

A modern payment processing system involves multiple entities and tools working together. The key players include:

- Customer (Cardholder): The person or business making a purchase with a payment card or other digital method.

- Merchant: The shop, website, or business selling goods/services and accepting payment.

- Payment Gateway: A secure service (often a software or device) that encrypts and transmits a customer’s payment data to the processor. Gateways act as the “bridge” between the merchant’s system and the financial network.

- Payment Processor: A company or system that routes transaction data between the merchant, card networks, and banks. The processor validates and forwards the payment information, handles authorization requests, and eventually initiates fund transfers.

- Merchant Account (Acquiring Bank Account): A special bank account held by the merchant with an acquiring bank. When a sale is authorized, the funds are first deposited into this account.

Later, the money is transferred from the acquiring bank into the merchant’s regular business bank account. Most card payments require some form of merchant account as an intermediate holding account. - Issuing Bank: The customer’s bank or financial institution that issued the credit/debit card. The issuing bank approves or declines transactions based on the cardholder’s funds or credit and fraud checks.

- Acquiring Bank (Merchant Bank): The financial institution that holds the merchant’s account and works with the payment processor. The acquiring bank receives transaction authorization requests and ultimately receives payment from the issuing bank before depositing funds to the merchant.

- Card Networks (Associations): Organizations like Visa, Mastercard, Discover, and Amex that operate the card payment networks. They set security and fee standards, and they route messages between issuing and acquiring banks.

Many smaller businesses do not deal with each of these components individually; instead, they use a payment service provider (PSP) or payment platform (like Stripe, Square, PayPal, etc.) that bundles them.

A PSP can offer an all-in-one solution: it may provide the payment gateway, obtain a merchant account with an acquirer on your behalf, and route transactions through the networks.

For example, Stripe is both a payment gateway and processor (a PSP) that handles the entire payment workflow for merchants. This simplifies setup: a business can sign up, use Stripe’s API or checkout tools, and accept payments immediately.

Point-of-sale (POS) systems in stores are another key component of in-person payments. A POS terminal or register is where the customer interacts and where the card is presented or entered.

Modern POS hardware often has the payment gateway built in, securely capturing card data on the spot. The POS then sends that data to the payment processor. In addition to handling payments, many POS systems integrate with inventory management and sales reporting.

Below is a summary of the different parts:

- Payment Gateway: Encrypts and sends payment data (credit card number, etc.) from the merchant’s site/terminal to the processor.

- Payment Processor: Receives encrypted data from the gateway, communicates with banks and networks to authorize and settle the payment.

- Merchant/Acquirer: Holds a merchant account; receives approved funds and deposits them into the merchant’s bank.

- Issuing Bank: Verifies cardholder’s funds/credit, sends approval/decline.

- Card Network: Routes transaction information between issuer and acquirer, and levies interchange fees.

- Customer (Cardholder): Initiates each transaction by presenting a payment method.

- Merchant: Completes the sale of goods or services once payment is approved.

Together, these components form the payment processing system. They must all follow strict security standards (e.g. PCI DSS) and data protection protocols (encryption, tokenization) to keep customer card data safe at every step.

How Payment Transactions Work: Step-by-Step

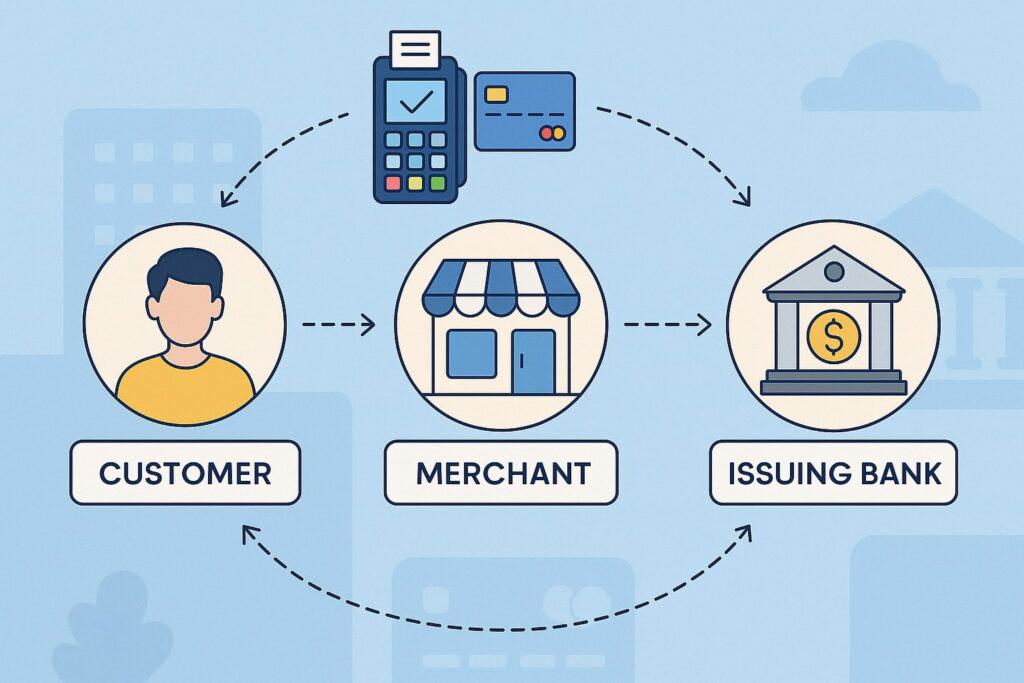

Payment processing happens in a series of stages. From the customer’s perspective, the transaction seems instantaneous. But under the hood, each sale goes through multiple steps involving communication between devices, networks, and banks.

The high-level stages of a typical credit or debit card transaction are often described as submission, authorization, authentication, clearing, and settlement. An illustrative diagram of these five steps is shown below:

In a typical card payment flow, the process involves five main stages: submission, authorization, authentication, clearing, and settlement. Below we explain each step in the context of both online and in-store payments.

1. Payment Initiation (Submission)

The first step is payment submission. The customer initiates the transaction by providing their payment details to the merchant. In an in-person sale, this means the customer swipes, inserts, or taps their credit/debit card (or presents a mobile wallet or contactless payment) at a point-of-sale terminal.

In an online or mobile purchase, the customer enters their card number, expiration, and security code on a website or app, or uses a saved card/wallet. As NMI explains, the submission stage is when “the cardholder makes the payment by tapping, swiping, inserting or entering their card details”.

At this point, the payment gateway or POS terminal captures the card data. For card-present transactions, the terminal reads the magnetic stripe or chip and optionally prompts for a PIN or signature.

For e-commerce, the website’s checkout form collects the card information. In all cases, the data is prepared to be sent securely. Many gateways immediately encrypt or tokenize the data so that raw card numbers are not exposed.

This is crucial for security. Essentially, submission is the act of capturing and packaging the payment information. Technically, it may happen in under a second, but it triggers the entire processing workflow.

2. Data Encryption and Transmission to Payment Gateway

Once the customer’s payment information is captured, the data is securely transmitted to a payment gateway or processor. If the business uses a payment gateway, this is the point where the gateway takes over.

For in-store terminals, the POS device often functions as the gateway. The gateway’s role is to encrypt and safely forward the transaction data. It “connects parties and transmits data using encryption”.

For example, Stripe notes that after a customer submits payment info, it is “securely transmitted to the payment gateway, which acts as a bridge… encrypting the transaction data” before sending it on. In other words, the gateway makes sure that card numbers and sensitive details cannot be intercepted en route.

In the online context, the payment gateway will receive the card details from your web store and may perform additional checks (like ensuring the format is correct). In many setups, the gateway forwards the transaction directly to the acquiring bank or to a payment processor’s servers.

In either case, the data now moves off the merchant’s system and into the broader banking network. From this point forward, the customer’s payment data travels through the payment processing system for authorization.

3. Transaction Authorization

After the payment gateway has sent the transaction data onward, the payment processor takes charge of authorization. The processor receives the encrypted payment data and typically performs initial validation (such as confirming the amount is formatted correctly, the account exists, etc.).

It then forwards the authorization request to the merchant’s acquiring bank (or sometimes directly into the card network). The acquirer then routes the transaction to the card association/network (Visa, Mastercard, etc.), which, in turn, routes it to the issuing bank (the customer’s bank).

The issuing bank now evaluates the request. It checks that the account is valid and that the customer has enough funds or credit available.

It also applies fraud-prevention checks (for example, verifying the CVV code, checking the shipping address with the billing address, or running velocity checks). If everything checks out, the issuing bank approves the transaction. If not (say, insufficient funds or flagged fraud risk), it declines.

This authorization stage happens in seconds. As Worldpay describes, when the issuing bank assures the account is in good standing, it sends an approval code back through the network to the acquiring bank, which then passes it along to the merchant.

In practice, the entire round-trip – from customer tap to bank approval – takes only 2–3 seconds on average. If approved, the issuing bank places a temporary hold on the funds (reserving that amount) but does not yet transfer money. The authorization response (approval or decline) is relayed back along the chain.

4. Authorization Response

Next is the authorization response. Whatever the issuing bank decides (approve or decline) is communicated back to the merchant. The response flows from the issuing bank, through the card network, to the acquiring bank, to the payment processor, to the gateway, and finally back to the merchant’s system.

The payment gateway then notifies the merchant’s website or POS device of the result. If the payment is approved, the merchant completes the sale: the goods are given to the customer or the digital content is delivered. If it is declined, the customer is typically asked for another payment method.

From the merchant’s perspective, this is the point where you might see an “approved” or “declined” message. The important part is that all parties (merchant, acquirer, issuing bank) get the same status code.

According to Stripe’s overview, the authorisation response goes back through the chain “through the card network to the acquiring bank, which then forwards the response to the payment processor… which communicates the result to the business’s POS or online platform”.

This completes the front-end payment process. To the customer, the payment looks instantaneous, and they receive a receipt or confirmation right away.

5. Transaction Settlement (Batching and Clearing)

Authorizing a transaction is like making a reservation of funds; settlement is the final step where money actually moves. Settlement usually happens after authorization and often involves batching multiple transactions together.

At the end of the business day (or at scheduled intervals), the merchant’s system compiles all approved transactions and submits a batch to the acquiring bank or processor. In Stripe’s terms, “the business sends a batch of approved transactions to the payment processor or acquiring bank for settlement”.

Once the batch is sent, the card network begins the clearing process. Each transaction in the batch is individually routed from the acquirer through the payment processor and the card network to the issuing bank.

The issuing bank then deducts the transaction amounts from the cardholders’ accounts. This is the clearing stage, where the issuing bank debits its customer and “clears” the payment.

Interchange fees (the fee paid to the issuing bank) are calculated and deducted during clearing. The issuing banks then pass the funds (minus their fees) to the card network.

Finally comes settlement (funding): the card network sends the collected funds to the acquiring bank. The acquiring bank takes the settlement payment and deposits the net total of all transactions into the merchant’s business account.

Settlement times vary by provider, but for most card payments in the U.S., funds are deposited into the merchant’s bank account within 1–3 business days after batch submission.

Worldpay notes that often the issuing bank transfers funds to the acquiring bank the next day, and the acquiring bank then deposits them into the merchant’s account (sometimes same day, usually next day).

Once settled, the transaction is fully complete. The merchant’s system reconciles the payments: matching each settled transaction to sales records and subtracting any fees charged by the processor or bank.

Meanwhile, customers see the transaction appear on their bank or card statements, and the payment processor issues detailed reports to the merchant.

In summary, a single payment’s journey involves authorization (real-time) followed by batching, clearing, and funding (which finalizes the payment). Each transaction thus goes through an authorization phase and a separate settlement phase.

All of this ensures that money flows securely and accurately from the customer’s account to the merchant’s.

Online vs. In-Person Payment Processing

Payment processing can occur both online (card-not-present) and in physical stores (card-present). While the core steps are similar—capture data, authorize, settle—there are some differences in how they happen.

- Online (eCommerce) Payments: When customers pay on a website or app, it’s a card-not-present (CNP) transaction. The cardholder enters details manually or uses a digital wallet (like Apple Pay, Google Pay) which still ultimately passes card data or a token.

The payment gateway is usually software-based (embedded in the website) and handles encryption in real time. E-commerce gateways often support features like 3D Secure to authenticate users and reduce fraud.

Online systems automatically calculate tax, handle recurring subscriptions, and offer various digital payment methods (cards, ACH bank debits, PayPal, etc.).

Because the card isn’t physically present, online transactions carry a higher fraud risk and chargeback likelihood. Merchants often use fraud tools (AVS address checks, CVV verification, fraud scoring) to mitigate this risk. - In-Person (Point-of-Sale) Payments: In a brick-and-mortar shop or restaurant, payments are card-present. The customer dips or taps their EMV chip card, swipes a magstripe, or waves a mobile wallet at a contactless reader.

The POS terminal (or mobile card reader) is connected to a payment gateway built into the device. When the card is presented, the POS captures the card number and often asks for a PIN or signature to authenticate the cardholder.

Modern POS systems also handle receipts, cash drawer operations, and inventory. According to staxpayments, a simple in-person payment flow is: (1) customer swipes/inserts/taps card, (2) the POS system communicates with the bank for approval, and (3) payment is processed and a receipt is generated.

In-person transactions tend to have lower fraud risk than online, since the physical card and cardholder are present to verify. However, they require hardware (card readers, NFC terminals) and often have different rates.

In-person payment example: A modern point-of-sale terminal (shown above) collects the customer’s card data (via chip, magstripe, or NFC) and securely transmits it through the payment processing system for authorization. Devices like this are ubiquitous in retail stores and enable quick card-present transactions.

The choice of gateway/processor can also differ. Online-only merchants may use hosted payment pages or API-based gateways and can work with Payment Service Providers (PSPs) that bundle all services. Physical stores often use dedicated payment terminals (from companies like Square, Clover, Toast, Verifone) and may connect directly to an acquiring bank or use integrated processors. Some all-in-one platforms (like Shopify POS or Stripe Terminal) support both channels using the same account, while other merchants might use separate systems for online and offline.

Despite these differences, the fundamental workflow (capture → gateway → authorization → settlement) remains consistent. Whether the payment is online or in person, the payment processing system ensures transaction data flows safely through the networks and that the merchant eventually receives the funds.

Types of Payment Methods

Payment processing systems handle more than just traditional credit cards. Businesses can often accept a variety of payment types through their processor:

- Credit and Debit Cards: The most common forms (Visa, MasterCard, Amex, Discover, etc.). Accepted by virtually all gateways.

- Digital Wallets: Mobile app wallets like Apple Pay, Google Pay, Samsung Pay, or online wallets like PayPal and Venmo. These often tokenize the card details but ultimately use the card networks.

- Bank Transfers and ACH: Electronic Funds Transfer (EFT) or Automated Clearing House (ACH) payments allow customers to pay directly from their bank account. Many platforms support ACH for B2B or high-ticket payments.

- E-Checks: Paper checks converted to electronic transactions via the ACH system. Useful in some business-to-business contexts.

- Buy Now, Pay Later (BNPL): Services like Klarna or Affirm that let customers finance purchases; the merchant still gets paid up front through a payment partner.

- Cryptocurrency (Rare): A small number of merchants accept bitcoin or other crypto via special processors, but this is outside the traditional card networks.

Each method routes through payment processors differently (e.g. ACH doesn’t use Visa/Mastercard networks). But most modern gateways and PSPs support multiple methods.

For online sellers, offering diverse payment options can boost sales and customer convenience. For in-store, the main methods are card and mobile wallet; cash is still accepted in many places but is outside the scope of electronic payment processing.

Security and Compliance

Security is paramount in payment processing. Because sensitive data (card numbers, CVV, personal info) is involved, systems use strong protections:

- Encryption: All payment data is encrypted in transit. Gateways use SSL/TLS, and processors often encrypt data in their databases. Modern systems also use tokenization, replacing card numbers with unique tokens that are useless if stolen.

- PCI DSS Compliance: Any business accepting cards must adhere to the Payment Card Industry Data Security Standard (PCI DSS). This standard mandates secure network configurations, limited data storage, regular scans, and more. Using a reputable, PCI-compliant gateway/processor greatly reduces risk and compliance burden.

- Secure Authentication: For online payments, merchants can enable 3D Secure (e.g. “Verified by Visa”) which adds a customer authentication step (like a one-time code). For in-store chip transactions, EMV chips and PIN entry add security.

- Fraud Detection: Processors and gateways often provide fraud scoring and AVS/CVV checks to flag suspicious transactions. Merchants should monitor transactions and set up velocity or geography filters if needed.

Following best practices – using a secure gateway, keeping software updated, and training staff – helps maintain a secure payment environment. For example, Stripe recommends encryption, tokenisation, SSL, and strict PCI compliance to protect cardholder data.

The overall goal is that neither the merchant nor the processor exposes raw card details; only authorized parties and systems handle the data, and usually only in an encrypted form.

Fees and Costs of Payment Processing

Payment processing is not free; every transaction typically incurs fees. The main cost components are:

- Interchange Fees: These are fees set by the card networks and paid to the issuing banks. They make up the bulk of processing cost (often 70–90%). Interchange rates vary by card type, region, and merchant category.

- Assessment Fees: Small fees (around 0.11–0.15%) charged by card networks (Visa, Mastercard, etc.) on top of interchange.

- Processor Markups: On top of interchange/assessments, the payment processor (or acquirer) adds their own fee. This might be a percentage plus a fixed fee per transaction.

- Gateway Fees/Monthly Fees: Some gateways charge a monthly fee or per-transaction gateway fee for using their service.

- Chargeback Fees: If a customer disputes a charge and it leads to a chargeback, merchants may pay an additional fee (e.g. $20–$100 per chargeback).

In total, credit card processing fees for U.S. merchants typically range between about 1.5% and 3.5% of each transaction. Small businesses might see higher rates (up to 3% or more) if they don’t negotiate or if they use certain card types.

Debit cards generally incur lower interchange rates than credit cards. For online (card-not-present) transactions, fees tend to be on the higher side of the range. Payment networks publish interchange tables, but merchants usually pay a bundled rate (often called “swipe fee” or “transaction fee”) charged by the processor.

For example, Ramp notes that “processing fees typically include interchange fees, assessment fees, and processor markups” and that these can range roughly from 1.5% to 3.5% per transaction, depending on business volume and card type.

It’s important to ask potential processors how their fees break down. Using modern processors or PSPs (like Stripe, Square, Shopify Payments, etc.) often means there are no hidden fees or monthly minimums, but the per-transaction rate will reflect their margin.

Large merchants with high volume often negotiate better interchange-plus pricing or flat fees, but small businesses typically pay standard rates.

Understanding fees is critical for cost management. Merchants should periodically compare rates from different processors, watch out for monthly service fees or PCI compliance fees, and choose plans that fit their sales volume and average ticket size. Offering lower-cost payment options (like debit or ACH) can also reduce fees where possible.

Choosing a Payment Processor

Given the complexity of payment processing, businesses often rely on third-party payment service providers (PSPs) or processors that handle integration, compliance, and relationships with banks. When choosing a provider, consider:

- Supported Channels: Does it support both your online store and in-store? (e.g. Stripe supports e-commerce and has SDKs for in-person readers; Square is known for in-person POS).

- Payment Methods: Ensure it can process credit/debit cards and any alternative payments you need (ACH, wallets, etc.).

- Fees: Check the transaction and monthly fees, including international and interchange rates.

- Ease of Integration: For developers, look at available APIs, plugins, and documentation.

- Security: Confirm PCI compliance and security certifications.

- Payout Speed: Some providers deposit funds faster than others (daily vs weekly, etc.).

- Support & Fraud Tools: Good customer support and built-in fraud prevention tools can save headaches.

In many cases, small businesses will use a PSP like Stripe, PayPal, Square, or an all-in-one payment gateway that also provides a merchant account. Larger enterprises might engage directly with acquirers or use payment facilitators (PayFacs) that onboard sub-merchants (e.g. if you run a marketplace platform).

Ultimately, the payment processing system you choose should fit your sales model, scale, and technical needs. The right processor makes it easier to accept payments globally and handle different currencies and payment methods while ensuring compliance and security.

The Future of Payment Processing

Payment processing technology continues to evolve. Trends affecting the industry include:

- Mobile and Contactless Payments: The U.S. has seen a surge in contactless transactions (e.g. Apple Pay, tap-to-pay cards). Some analysts project billions of contactless transactions soon. Retailers and merchants are increasingly enabling NFC and QR-code payments at checkout.

- Real-Time Payments (RTP): New infrastructures like the RTP network in the U.S. allow instant bank-to-bank transfers. While traditional card rails still dominate consumer transactions, these faster settlement systems are growing.

- Open Banking and Account-to-Account (A2A) Payments: In some markets, connecting directly to customer bank accounts (via APIs) is becoming an alternative. In the U.S., ACH remains common for direct debits.

- Tokenization Everywhere: As more cardholders store cards in digital wallets, the concept of tokenized payments (dynamic tokens in place of PANs) is spreading even to in-person terminals for added security.

- Regulation and PSD2-like Changes: Though PSD2 is EU-specific, U.S. regulators are showing interest in data portability and security. Encryption and fraud measures continue to get stricter.

- Buy Now, Pay Later (BNPL): Many retailers now offer installment options at checkout (via partners like Klarna, Affirm). While technically offloading risk to the BNPL provider, these still go through a payment processor at the point of sale.

- Cryptocurrency Payments: A niche but growing area; some processors now enable accepting crypto, though adoption in mainstream retail is still limited.

For U.S. businesses, staying current means ensuring your payment system can adapt. Most major payment processors roll out new features (e.g. digital wallets, contactless, QR payments) and international capabilities.

Monitoring trends like increased card-not-present volumes (post-pandemic e-commerce growth) or new fraud threats is part of maintaining a modern payment strategy.

With the foundations solidly in place (secure gateways, robust processing networks, and reliable settlement), merchants can focus on providing a smooth checkout experience. The key is that the underlying payment processing system runs silently and reliably, so businesses can accept payments 24/7 without hiccups.

Frequently Asked Questions

Q: What is the difference between a payment gateway and a payment processor?

A: A payment gateway is the service or device that captures and encrypts the customer’s payment information at checkout and forwards it. A payment processor is the system that actually routes the transaction data between banks and handles the authorization and settlement.

In simple terms, the gateway is the front-end that touches the customer, while the processor is the back-end engine. Many payment providers bundle both functions, but technically the gateway secures the data, and the processor moves money.

Q: How long does a payment take to reach my bank account?

A: After a sale is authorized, merchants usually receive funds in 1–3 business days. This delay is due to the batching/settlement process. Many processors deposit next-day or within 2 days for card transactions.

According to industry guides, “funds are typically settled in daily batches and transferred within 1–3 business days, depending on your processor”. Newer “instant payout” services exist, but they often charge extra.

Q: Why was my credit card transaction declined?

A: There can be many reasons: insufficient funds or credit, a wrong CVV or billing address, an expired card, a hold on the account, or suspected fraud. The issuing bank always makes this decision during the authorization step.

The merchant’s terminal or website will simply get a decline code. If this happens, the customer should try a different card or payment method. From the technical side, the payment processing system does not give out reasons; it only relays the decline code sent by the bank.

Q: What is PCI compliance and why is it important?

A: PCI DSS (Payment Card Industry Data Security Standard) is a security standard enforced by the card networks. Any business that accepts cards must comply. It sets requirements for how card data is stored, transmitted, and processed.

The goal is to reduce fraud and breaches. For most merchants, using a PCI-compliant gateway/processor means much of the compliance burden is handled for you. But you still need to follow best practices like not storing full card numbers on your servers and using secure networks.

Q: Do I need a merchant account to accept payments?

A: Traditionally, yes: a merchant account (with an acquiring bank) is how card payments are received. However, many modern payment providers (PSPs) handle this for you. For example, if you use Stripe or Square, you often don’t see a separate “merchant account” — they effectively provide it behind the scenes.

These companies act as intermediaries, so you can accept cards without directly setting up a bank account for merchants. Be aware that PSPs typically charge slightly higher fees for this convenience.

Q: Can I accept payments online and in person with the same system?

A: Many payment platforms support both. For example, Square and Stripe offer SDKs/hardware for in-store POS as well as online checkout solutions. Using one provider can unify reporting and settings.

However, some businesses use different processors for online (to get better international acceptance or features) and for in-store (to use certain hardware). When choosing, look for providers that fit all your sales channels.

Q: Are there alternatives to credit card processing?

A: Yes. Aside from cards, you can accept ACH/eCheck (bank transfers), digital wallets (PayPal, Venmo), or cash and checks (though those involve different clearing). The payment system described here mostly covers electronic methods.

Choose the options that your customers prefer; adding methods like Apple Pay, Google Pay, or even BNPL (Buy Now, Pay Later) can capture more sales. Each non-card method still typically routes through some electronic payment system or partner.

Q: What happens if there is a chargeback?

A: A chargeback is when a customer disputes a charge and the bank returns the money to them. In processing terms, this triggers a reversal of the settlement process. The merchant may have to provide proof of the transaction (receipt, shipping confirmation, etc.) to fight the chargeback.

Payment processors charge a fee for chargebacks, and merchants must follow specific dispute rules. A good payment processing system provides tools to help manage and respond to disputes.

Conclusion

Payment processing is a vital, multi-step system that allows money to flow from customer to merchant securely and efficiently.

Whether in a brick-and-mortar store or on an e-commerce site, the process follows similar stages: the customer submits payment data, a gateway securely transmits that data, a processor and card network authorize the transaction with the issuing bank, and finally the funds are settled into the merchant’s account.

Each step requires coordination among gateways, processors, banks, and networks to verify and move funds.

Businesses must choose the right payment processing solution — often via a payment service provider — to handle these steps automatically.

By understanding how payment processing works and what components are involved, merchants can ensure they provide a smooth checkout experience while maintaining security.

With strong encryption, fraud checks, and compliance in place, modern payment systems make transactions easy for customers and reliable for businesses.

For any merchant (online or offline), a correctly implemented payment processing system means selling with confidence, knowing that once a customer says “pay,” the money will flow to the business in a matter of seconds (for authorization) and days (for settlement) without manual intervention.